Fraud & Security

Keeping your information secure is Century Bank & Trust’s top priority. We offer several features in online banking that help keep your information secure while you are using our product.

Secure Login Features

In addition to the user ID and password, enhanced security features 2-Multi-Factor Authentication has been added to Online Banking users.

Multi-Factor Authentication

Is required and the user has different options to select from to receive the 2MFA code at time of login.

Benefits of Multi-Factor Authentication

- Provides peace of mind regarding Online Banking authentication

- An easy option to add another layer of protection

- Usable anywhere at any time

- Protects against phishing, pharming, dictionary attacks and keystroke logging viruses

- Robust protection against unauthorized access, even with stolen password credentials

Small Business Computer Security Basics Guide

The FTC’s new web page offers specific information to help small businesses protect their networks and their customer data. This includes a new Small Business Computer Security Basics guide, which shares computer security basics to help companies protect their files and devices, train employees to think twice before sharing the business’s account information, and keep their wireless network protected, as well as how to respond to a data breach. It also has information on other cyber threats such as ransomware and phishing schemes targeting small businesses.

Small Business Computer Security Basics Guide

Additional Resources

Empowering the Georgia community.

Why We Made the Move to Century.bank and What It Means for You

We have officially moved to a new web address Century.bank. Our new .bank domain is part of a…

Read More

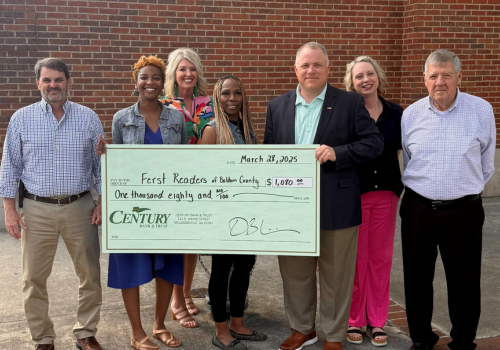

Century Donates to Ferst Readers of Baldwin County, Supporting Early Literacy

04/03/2025

Century is proud to support early childhood literacy by donating to Ferst Readers of Baldwin County.

Read More

Steps to Mortgage Approval with Century Bank and Trust

04/01/2025

Here are the essential steps to getting approved for a mortgage with Century.

Read MoreUse this calculator to determine your projected earnings from our Kasasa Cash account. Move the sliders or type in the numbers to see your potential rewards.

- Estimated Annual Rewards $0

- Estimated monthly interest earned* $0

- Monthly ATM fees refunded**$0

This calculator compares the costs of buying or leasing a vehicle. There are three sections to complete, and you can adjust and experiment with different scenarios.

- Net cost of buying $0

- Net cost of leasing $0

A fixed-rate, fixed-term CD can earn higher returns than a standard savings account. Use this calculator to get an estimate of your earnings. Move the sliders or type in numbers to get started.

- Total value at maturity $0

- Total interest earned $0

- Annual Percentage Yield (APY)0.000%

Whether it's a down payment, college, a dream vacation...a savings plan can help you reach your goal. Use the sliders to experiment based on length of time and amount per month.

- Monthly deposit needed to reach goal $0

This calculator can help you get a general idea of monthly payments to expect for a simple loan. Move the sliders or type in numbers to get started.

- Estimated monthly payment $0

- Total paid $0

- Total interest paid $0

Business Certificates of Deposit

| Term | Interest Rate | APY | Compound Method |

|---|---|---|---|

| 90 Day | 0.20% | 0.20% | Simple |

| 180 Day | 0.50% | 0.50% | Simple |

| 12 Month | 0.75% | 0.75% | Quarterly |

| 18 Month | 0.80% | 0.80% | Quarterly |

| 24 Month | 0.95% | 0.95% | Quarterly |

| 30 Month | 1.00% | 1.00% | Quarterly |

| 36 Month | 1.15% | 1.15% | Quarterly |

| 48 Month | 1.25% | 1.26% | Quarterly |

| 60 Month | 1.30% | 1.30% | Quarterly |

The Annual Percentage Yield (APY) assumes the interest remains on deposit until maturity. A withdrawal of interest will reduce earning. Minimum deposit to open account is $500.

Business Money Market Account

| Account Balance | Interest Rate | APY |

|---|---|---|

| $0 - $2,499.99 | 0.00% | 0.00% |

| $2,500 - $24,999.99 | 0.35% | 0.35% |

| $25,000 - $49,999.99 | 0.40% | 0.40% |

| $50,000 - $99,999.99 | 0.45% | 0.45% |

| $100,000 - $249,999.99 | 0.50% | 0.50% |

| $250,000 - $499,999.99 | 0.50% | 0.50% |

| $500,000 - $999,999.99 | 0.55% | 0.55% |

| $1,000,000+ | 0.55% | 0.55% |

Business NOW Checking

| Account Balance | Interest Rate | APY |

|---|---|---|

| $0 - $2,499.99 | 0.00% | 0.00% |

| $2,500 - $24,999.99 | 0.25% | 0.25% |

| $25,000 - $49,999.99 | 0.30% | 0.30% |

| $50,000 - $99,999.99 | 0.35% | 0.35% |

| $100,000 - $249,999.99 | 0.40% | 0.40% |

| $250,000 - $499,999.99 | 0.40% | 0.40% |

| $500,000 - $999,999.99 | 0.50% | 0.50% |

| $1,000,000+ | 0.50% | 0.50% |

Certificates of Deposit

| Term | Interest Rate | APY | Compound Method |

|---|---|---|---|

| 90 Day | 0.30% | 0.30% | Simple |

| 180 Day | 0.35% | 0.35% | Simple |

| 12 Month | 0.40% | 0.40% | Quarterly |

| 18 Month | 0.45% | 0.45% | Quarterly |

| 24 Month | 0.50% | 0.50% | Quarterly |

| 30 Month | 0.55% | 0.55% | Quarterly |

| 36 Month | 0.60% | 0.60% | Quarterly |

| 48 Month | 0.65% | 0.65% | Quarterly |

| 60 Month | 0.70% | 0.70% | Quarterly |

The Annual Percentage Yield (APY) assumes the interest remains on deposit until maturity. A withdrawal of interest will reduce earning. Minimum deposit to open account is $500.

Kasasa Cash®*

| Account Balance | Minimum Opening Deposit | Interest Rate | APY |

|---|---|---|---|

| $0 to $24,999.99 | $50 | 3.45% | 3.50% |

| $25,000+ | $50 | 0.249% | 3.50% to 0.90% |

| All balances if qualifications not met | $50 | 0.05% | 0.05% |

Qualifications to Earn Rewards

All that stands between you and your rewards are things you probably do anyway. Enrollments must be in place and all of the following transactions and activities must post and settle to your Kasasa Cash account during each Monthly Qualification Cycle:

- At least 12 debit card purchases

- Be enrolled in online banking

- Be enrolled in and agree to receive eStatements

And even if you don't meet your qualifications during the month, your Kasasa Cash account is still free — and you'll still earn our base rate of interest.

Kasasa Saver®*

| Account Balance | Minimum Opening Deposit | Interest Rate | APY |

|---|---|---|---|

| $0 to $24,999.99 | $50 | 1.24% | 1.25% |

| $25,000+ | $50 | 0.249% | 1.25% to 0.45% |

| All balances if qualifications not met | $50 | 0.05% | 0.05% |

Qualifications to Earn the Higher Rate

Qualifying for your Kasasa Cash or Kasasa Cash Back® account automatically qualifies you for the highest Kasasa Saver rate, too. Enrollments must be in place and all of the following transactions and activities must post and settle to your Kasasa Cash or Kasasa Cash Back account during each Monthly Qualification Cycle:

- At least 12 debit card purchases

- Be enrolled in online banking

- Be enrolled in and agree to receive eStatements

That's it! And even if you don't meet your qualifications during the month, your Kasasa® accounts are still free — and you'll still earn our base rate of interest on Kasasa Saver.

Money Market Account

| Account Balance | Interest Rate | APY |

|---|---|---|

| $0 - $24,999.99 | 0.35% | 0.35% |

| $25,000 - $49,999.99 | 0.40% | 0.40% |

| $50,000 - $99,999.99 | 0.45% | 0.45% |

| $100,000+ | 0.50% | 0.50% |

Savings Accounts

| Account | Balance | Interest Rate | APY |

|---|---|---|---|

| Regular Savings | $0 - $200 | 0.15% | 0.15% |

| Regular Savings | $200+ | 0.30% | 0.30% |

| Christmas Savings | All Balances | 0.30% | 0.30% |